Paychex Payroll Check Stub free printable template

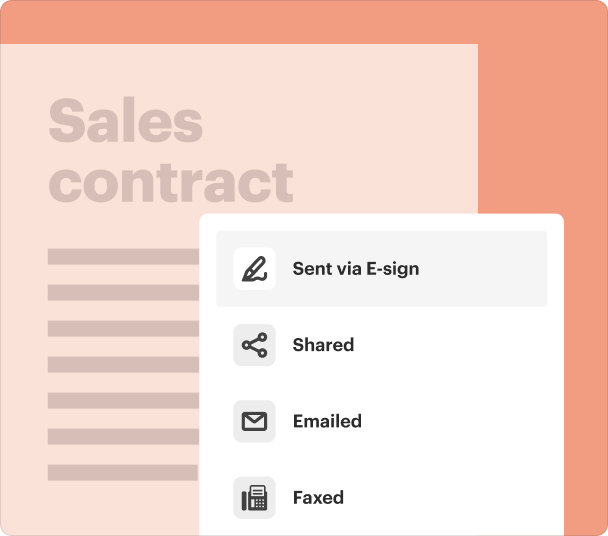

Fill out, sign, and share forms from a single PDF platform

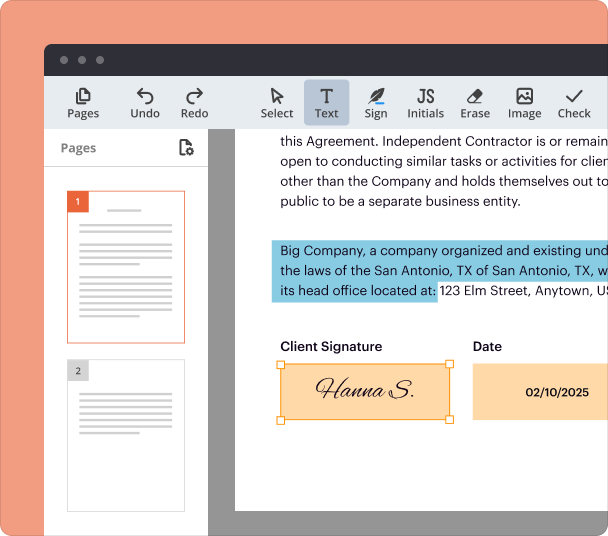

Edit and sign in one place

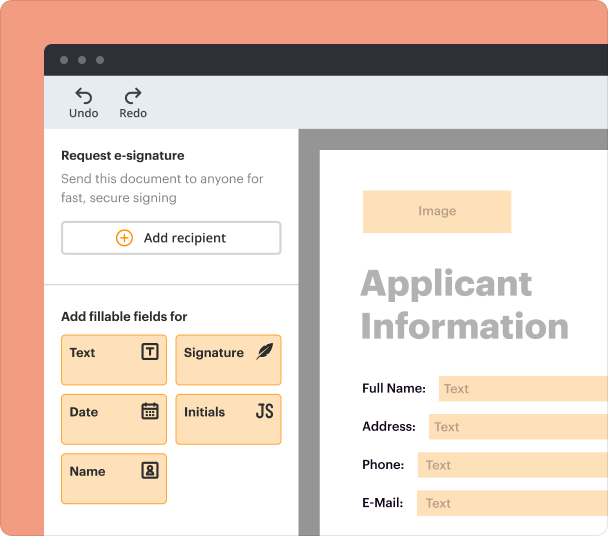

Create professional forms

Simplify data collection

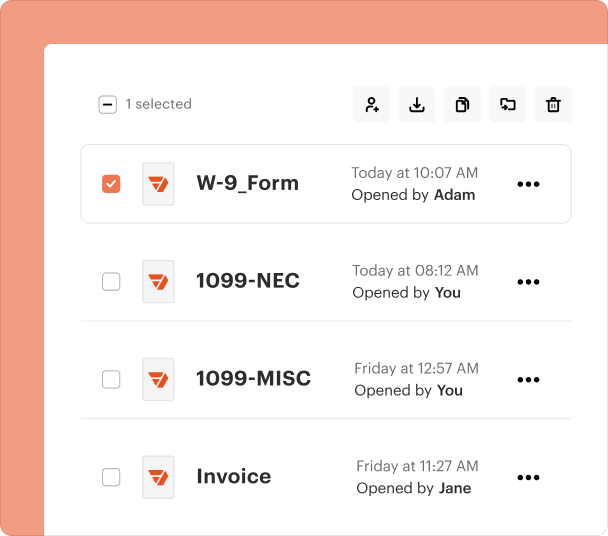

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

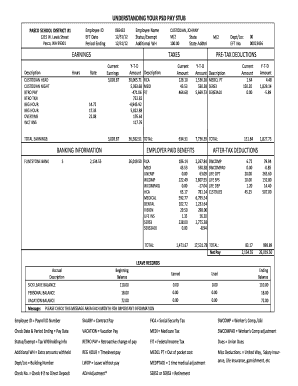

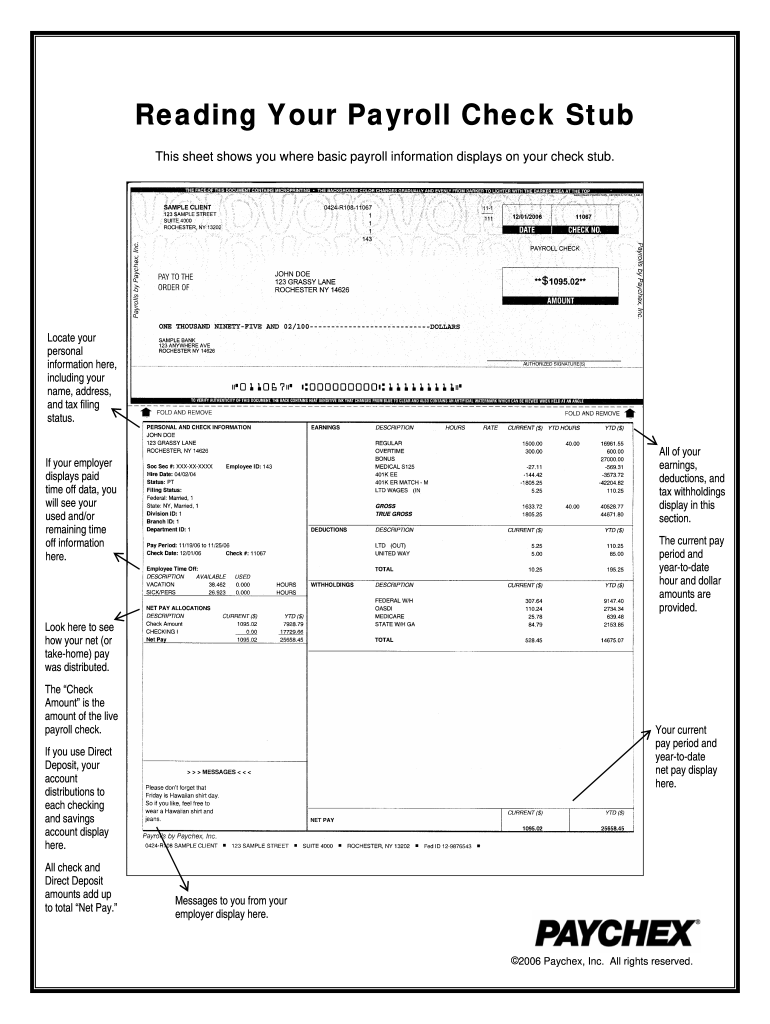

Understanding the Paychex Payroll Check Stub Form

What is the Paychex Payroll Check Stub Form?

The Paychex payroll check stub form is a detailed document provided by employers to employees to summarize wages earned, deductions taken, and other crucial payroll information for a particular pay period. This document serves as a record of earnings and can be essential for tax preparation, personal financial management, and verifying employment details.

Key Features of the Paychex Payroll Check Stub Form

The Paychex payroll check stub form includes several important features that facilitate understanding of payroll details. Key components of the stub are:

-

Includes employee name, address, and tax filing status.

-

Shows gross pay, net pay, and categorized earnings.

-

Lists all deductions made for taxes, benefits, and other contributions.

-

Highlights all earnings and deductions for the current calendar year.

How to Fill Out the Paychex Payroll Check Stub Form

Filling out a Paychex payroll check stub form can typically be handled easily, with clear fields for each required piece of information. Ensure you accurately enter personal details, verify earnings against pay records, and confirm that all deductions are accounted for. Following a checklist while filling out the form can prevent errors and omissions.

Common Errors and Troubleshooting

When completing the Paychex payroll check stub form, it is important to watch for common errors such as incorrect personal details, miscalculations of earnings, and omissions in reporting deductions. If discrepancies arise, review each section carefully and cross-reference with pay records. If issues persist, reach out to the payroll department for assistance.

Benefits of Using the Paychex Payroll Check Stub Form

Utilizing the Paychex payroll check stub form offers several benefits. It provides a clear overview of compensation, helps track financial progress over time, and is instrumental in preparing for personal taxes. Additionally, having readily available payroll records enhances transparency between employers and employees, fostering trust and ensuring clarity in financial dealings.

Who Should Use the Paychex Payroll Check Stub Form?

The Paychex payroll check stub form is primarily used by employees receiving paychecks through their employer. Employers must also familiarize themselves with the form to ensure its accuracy when distributing pay each cycle. This form is beneficial for self-employed individuals who wish to track their earnings for tax purposes.

Security and Compliance for the Paychex Payroll Check Stub Form

Maintaining the privacy of employee information on the Paychex payroll check stub form is of utmost importance. Employers should follow all federal and state guidelines regarding payroll documentation and ensure that only authorized personnel have access to sensitive data. Regular audits should be conducted to guarantee compliance with relevant laws.

Frequently Asked Questions about paychex pay stub generator form

What should I do if my paycheck information is incorrect?

If you notice any inaccuracies on your paycheck, review the provided pay records, then contact your employer’s payroll department for clarification or corrections.

Can I receive my pay stub electronically?

Many employers, including those using Paychex, offer options for electronic delivery of pay stubs. Consult your employer to understand available preferences.

pdfFiller scores top ratings on review platforms